The club can now confirm its audited financial results for Carlisle United Association Football Club (1921) Limited, for the year ended 30 June 2024.

The Audited Annual Accounts for the year ended 30 June 2024 have been approved and lodged and will be available from Companies House shortly. We have also made them available on the official website so that fans can see the information, if they wish to do so. Click HERE to download the full accounts and detailed explanation.

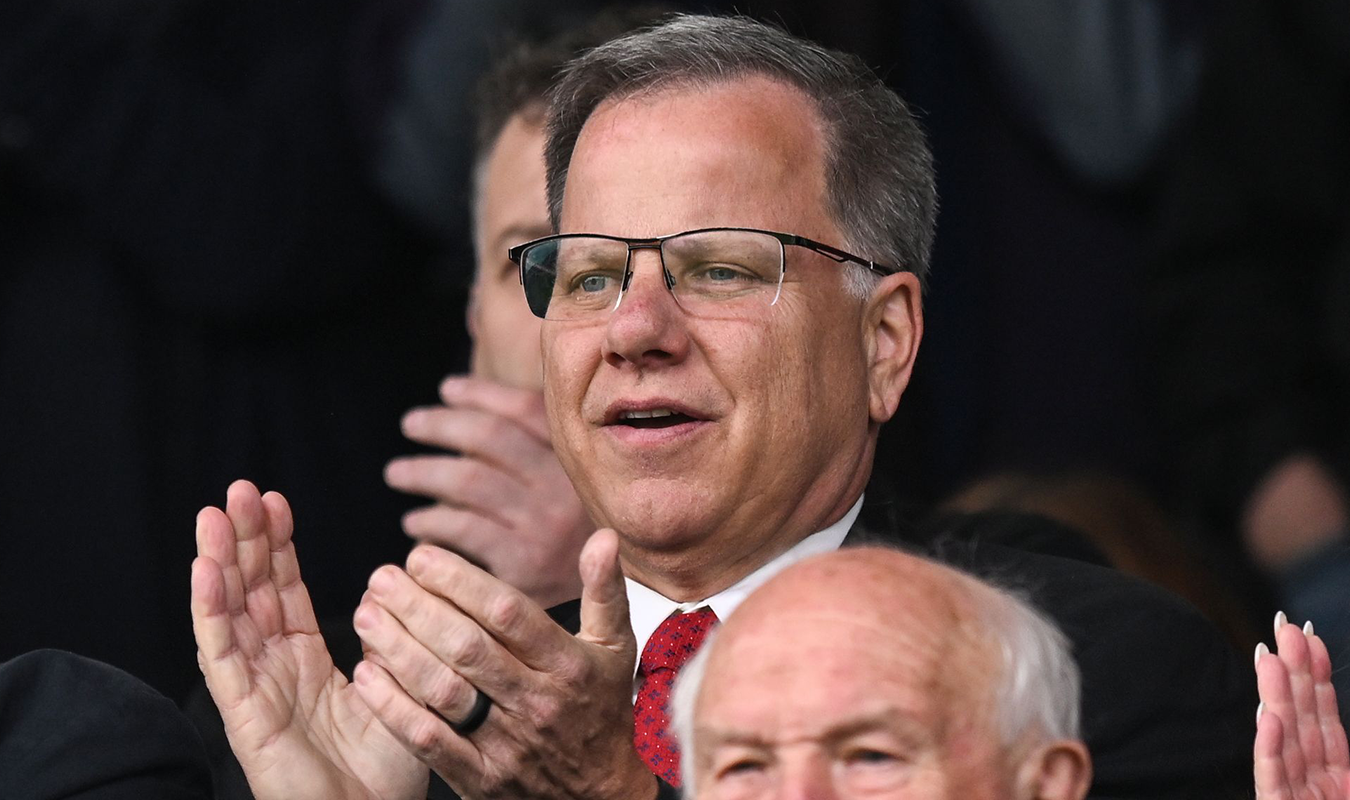

The year covers the business of the club, the acquisition of the club by Castle Sports Group Limited (“Castle”), the change of control to the Piatak family, a financial restructuring of legacy Purepay Retail debt, and the commencement of a significant investment programme in the club with associated funding from Castle during the League One season.

Profit before tax: £2.8m (22/23: loss £665,000)

Headline turnover: £8.31m (22/23: £5.29m). This includes recurring business income from tickets, retail and commercial, and one-off Football Fortune from player sales, cups and play-offs. This is up +57%.

Business Turnover: £4.12m (22/23: £3.06m). This measures the recurring revenue income generated by the Club’s operating activities off-the-pitch excluding one-offs like play-offs and cups. It includes ticket, commercial and retail income. The £1.07m increase (+35% up) reflects improvement across all income streams from both promotion and underlying growth. This is the highest Business Turnover on record, beating the previous record set in 22/23 in League Two. By growing recurring Business Turnover, the sustainability of the club is improved.

Professional Game Income £2.26m (22/23: £1.69m and 21/22: £1.63m). This comprises EFL distribution £954,000 (22/23: £652,000), Premier League Solidarity £778,000 (22/23: £480,000), which both increased due to being in League One. EPPP Academy grant income of £499,000 (22/23: £502,000) and LFE Academy education grants £27,000 (22/23: £55,000)

Recurring Income £6.38m (22/23: £4.74m) comprises Business Turnover and Professional Game Income combined and was again a record high.

Football Fortune: £1.9m (22/23: £430,000). This comprises Football Fortune income from cup runs £45,000 (22/23: £120,000), player sales £1.86m (22/23: £97,000) and playoffs and TV £nil (22/23: £213,000)

Total wages & salaries costs: £4.35m (22/23: £3.44m). This is the payroll cost of all club staff on and off the field, full or part time, including players and football staff.

Total Football Expenditure: £4.05m (22/23: £2.81m and 21/22: £2.20m). This includes all Player Costs and Other Football Expenditure in the first team (including travel, football IT, medical, recruitment and scouting, and all other first team football staff and coaches). It is the club’s total spending on Football.

Player transfer cash: £975,000 (22/23: £176,000) of cash received was received from deals in 23/24 and prior years, with £491,000 of cash used to acquire players.

Net assets: £10.9m (22/23: £8.1m) at 30 June 2024. This includes £14.4m attributable to stadium fixed assets which increased due to capex additions. A major investment began in the stadium with £2.9m added by the year end and a further £1.8m contracted for, as the East stand redevelopment continued. This is the largest off the field investment in the club in the last 20 years.

Net cash in hand was £802,000 (22/23: £1.58m) at 30 June 2024.

Debtors receivable for player sales: £1.02m (22/23:£132,000) at 30 June 2024. These will be collected in 24/25 and beyond. This excludes other contingent add-on amounts or possible sell-on income, which are not certain.

Funding of the club was provided by Castle which issued £4.8m of equity in the year, that was then provided to the club. £2.6m was used to repay the Purepay Retail Limited debt. The remainder was used for investment additions detailed above. Further equity was issued by Castle after the year end to fund completion of the East stand development [link https://www.carlisleunited.co.uk/news/financial-update-shares ].

Total debt down by £1.14m to £1.89m (22/23: £3.03m and 21/22: £3.16m) at 30 June 2024. This mainly comprises £1.66m of unsecured, interest free funding from CSG to fund the major ongoing capital investment in the stadium. The remaining balance is an unsecured and interest free amount due to Pioneer Food Group for historic funding provided under previous ownership. The net reduction in the year reflects the write-off of £2.6m by Castle (formerly due to Purepay Retail Limited), repayments to Pioneer, settlement of £40,000 of EFL loans and the new capex funding from CSG. The CSG balance will be restructured in 24/25 like its previous debt.

Financial KPIs 23/24 vs 22/23

- Headline turnover £8.31m £5.29m +57%

- Business income £4.12m £3.06m +35%

- Matchday £2.01m +27%

- Commercial £1.05m +20%

- Retail £1.0m +83%

- Underlying contribution £3.11m £2.15m +45%

- Wages & salaries £4.35m £3.44m) +53%

- Player transfer income £1.86m £97,000

- Wages % income 53% 65%

- Operating profit £206,000 £517,000 loss

- Overall profit £2.8m £665,000 loss

- Cash balance £0.8m £1.59m

- Player additions £491,000 £78,000

- Fixed asset additions £2.9m £144,000

- Total debt £1.89m £3.03m (all unsecured and interest free)

The 23/24 financial results show the underlying financial trading of the club continued to grow and strengthen significantly with Business Turnover increasing by +35%. The year saw the club’s best-ever business trading. All Business departments (tickets, retail, commercial, media) recorded their best-ever years. This was due to both promotion and a continuation of the underlying growth from 22/23 (when Business Turnover grew +54%).

Transfers in the Summer 2023 window and prior year resulted in significant Player income in 23/24. The cash will flow in over a number of years.

After many years of operating expenditure being limited to safety critical and essential areas only, this increased as we began to rebuild the operations and infrastructure of the club, resulting in increased staff numbers, higher overheads and increased off-the-field costs. This is the start of a process to catch up and make the club sustainable for the long term.

The club’s financial position is also much improved at the year end as a result of the takeover. With £0.8m of cash in the bank, third party debt down to £0.2m, the Purepay debt repaid by CSG and then written off by the new owners, all interest bearing and secured debt is removed. We had £1m of future cash receivable from player sales, no creditor pressure and all our PAYE and VAT liabilities were paid up in full and on time. This has continued since the year end and the finances of the club remain on a solid footing.